Opening a dedicated IBAN in Europe is often a major challenge for high-risk businesses. Traditional banks tend to refuse these clients, citing regulatory exposure, compliance costs, and reputational risks. As a result, many legitimate companies — from crypto projects to gaming, fintech, or nutraceuticals — find themselves unable to access basic banking services LegalBison. According to Eurochambres, regulatory barriers to bank accounts continue to slow down SMEs across Europe Eurochambres.

Why Traditional Banks Decline High-Risk Clients

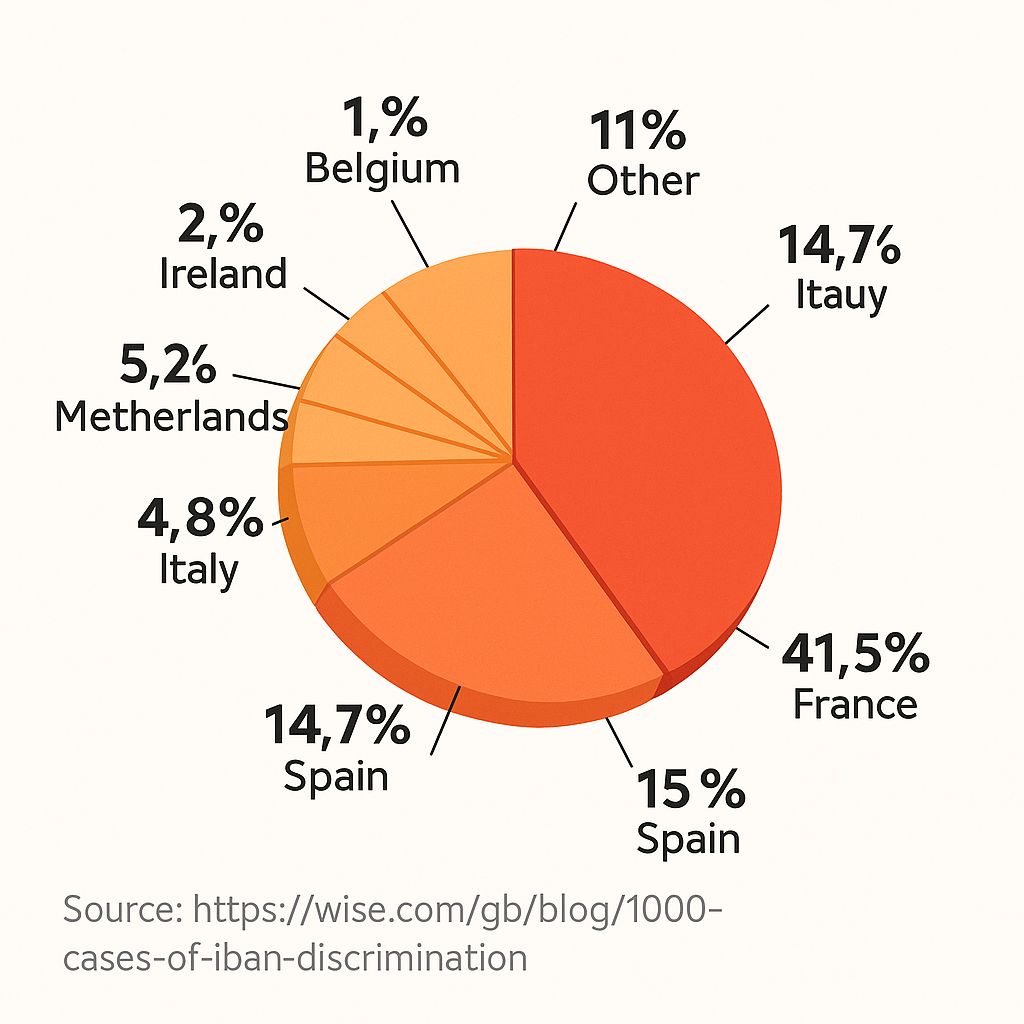

Banks in the EU operate under strict AML and MiCA regulations. High-risk industries are frequently perceived as too costly to monitor or too exposed to fraud. The result is “IBAN discrimination” — even businesses incorporated legally in the EU can face blocked or refused accounts. Between 2021 and 2023, over 3,500 such cases were reported in France and Spain alone Euronews.

Geographic split in IBAN discrimination across Europe

Step 1: Prepare Documentation

Before applying for a dedicated IBAN account, businesses must prepare full KYC/KYB packages, including company incorporation documents, proof of funds, ultimate beneficial owner (UBO) declarations, and business activity details. Incomplete or inconsistent documentation is one of the main reasons for rejections.

Step 2: Choose a Risk-Friendly Provider

Instead of relying on legacy banks, many businesses turn to risk-friendly financial providers like Xpaid. As a licensed EMI, Xpaid offers dedicated IBAN accounts tailored to high-risk industries. The difference lies in the infrastructure: onboarding processes are transparent, risk models are adapted, and compliance teams understand the specifics of high-growth but risk-classified industries. This ensures businesses can operate within legal frameworks without facing unnecessary shutdowns.

Step 3: Open the Account and Integrate Stablecoins

Once approved, companies can access euro-denominated corporate IBANs. With Xpaid, this account can also integrate seamlessly with stablecoin on/off ramp infrastructure, allowing businesses to combine traditional banking rails with digital assets. This hybrid approach enables faster settlements, cross-border payments, and a smoother experience for international partners.

Banking Access Without Barriers

High-risk businesses deserve fair access to financial services. By offering dedicated IBANs that combine compliance, stability, and crypto integration, Xpaid provides a solution where traditional banks hesitate. For industries shut out by legacy banking, Xpaid ensures continuity, growth, and global reach.