BCB Group is a leading provider of regulated payment and trading services for the digital asset economy. Its experience of going through different market cycles highlights the importance of mindset, focus, and communication in running a successful fintech.

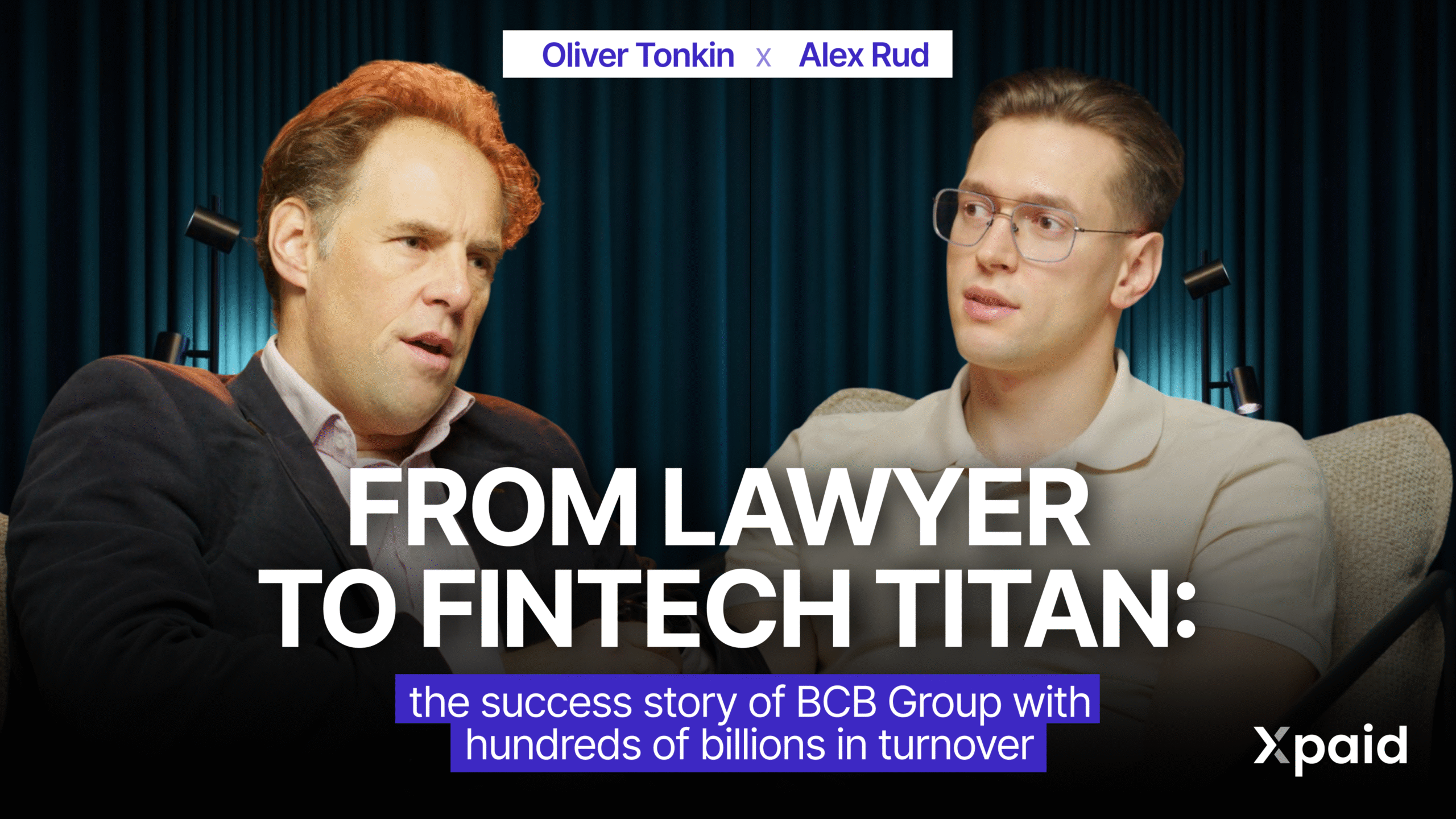

In this interview, Alex Rud, the CEO of Xpaid, speaks with Oliver Tonkin, the co-founder and CEO of BCB Group. With a career spanning over 25 years as an English lawyer and corporate M&A expert at firms like Norton Rose Fulbright and General Electric, Tonkin shares the story of how he transitioned from the “old economy” into the cryptosphere.

Key Takeaways

- Compliance first in pre-compliance era

How Tonkin’s ‘compliance-first’ mindset made BCB Group a bridge providing tier-one banking networks to crypto companies.

- Focus is everything

The history of Tonkin’s strategic mistake that was never repeated again.

- Caution > hype

A cautious decision saved BCB Group from the collapse that claimed firms like Celsius and FTX.

- Fake it till you make it

Before BCB Group built the scalable, automated code that powers the platform today, its automated appearance was maintained by manual work.

- The problems of niche recruitment

Tonkin emphasizes the importance of working with companies with extensive market knowledge.

- The importance of reaching out for help

Tonkin explains the role of mental health and mindfulness in successful leadership.

- The future is stablecoins

Stablecoins represent the most clear and compelling real-world use case for blockchain technology unlike Bitcoin whose long-term future is unclear.

- How to run a global fintech company

Tonkin shares what helps him successfully manage BCB Group that has offices all over the world and a lot of remote workers.

- Advice for founders

Tonkin shares personal advice for founders, emphasizing the importance of intellectual curiosity and the value of a professional network.