From Lawyer to Fintech Titan: The Success of BCB Group

BCB Group is a leading provider of regulated payment and trading services for the digital asset economy. Its experience of going through different market cycles highlights the importance of mindset, focus, and communication in running a successful fintech. In this interview, Alex Rud, the CEO of Xpaid, speaks with Oliver Tonkin, the co-founder and CEO […]

Top 4 Non-Centralized Exchange OTC Desks

In today’s digital finance scene, the needs of businesses are growing, as the traditional system is moving a bit slowly towards crypto and the frictions between the two are holding them back. Luckily, the latter adjusts, creating more effective and convenient ways to move big volumes of funds in crypto. Modern OTC desks demonstrate way […]

Countries With The Top Crypto Adoption 2026 – What Jurisdiction to Watch For?

In the coming year, the attention of cryptosphere participants is expected to shift away from the acknowledged headliners of the market. These used to be the USA and Western Europe; however, countries where rapid inflation and technological progress creates a strong demand for financial solutions, will lead crypto adoption 2026. “AI adoption models indicate a […]

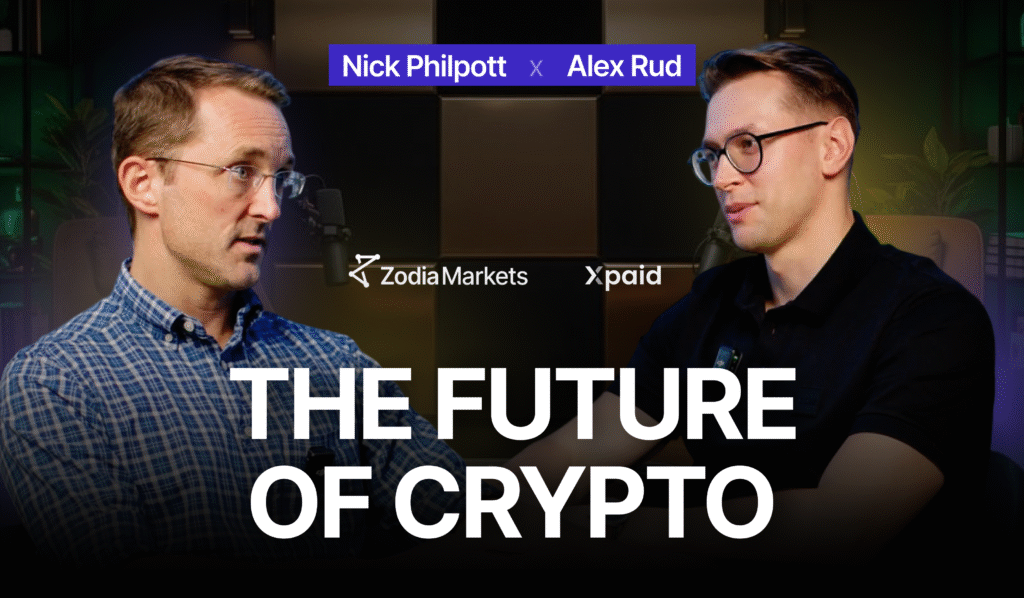

How Stablecoins Are Rewiring Global Finance: With Nick Philpott, Co-Founder of Zodia Markets

When we talk about the future of payments, the conversation often centers around buzzwords — blockchain, CBDCs, tokenization. But few people can break down what’s really happening inside global finance better than Nick Philpott, Co-Founder and Head of Partnerships of Zodia Markets, a Standard Chartered-backed platform bridging digital assets and traditional finance. In our latest […]

From Early Failures to Building OpenPayd, Bitpace & EMBank and Processing €130B

When most people think about building a bank, they imagine decades of tradition, cautious growth, and heavy bureaucracy. Today, OpenPayd is not only redefining the future of financial services but also processing over €130 billion every year. But what really lies behind this success? In our latest podcast, Alex Rud (CEO of Xpaid) spoke with […]

What Is a Crypto On/Off Ramp for Banks – A Simple Guide by Xpaid

As cryptocurrencies are widely adopted by all the participants of the financial system, the demand for safe, simple, and transparent tools for their use grows as well. Big businesses are actively stepping into the crypto game. To meet their needs, a perfect tool for integrating digital assets into the field of traditional finance has to […]

What is Proof of Funds and How to Prepare It Fast and Easily for Banks?

Today’s financial environment is a dynamic sphere that is rapidly adapting to the needs of users. One of them is adherence to the security standards of money flows, which allows you to make international transfers or open accounts abroad in accordance with the demands of regulatory authorities. To provide the transparency of financial processes, Proof […]

Legal, Transparent, Secure: Why Compliance Is at the Core of Xpaid’s Services

In today’s crypto and financial services environment, compliance is not just a requirement — it’s the foundation of legitimacy. For companies operating in and around Europe, licences like EMI (Electronic Money Institution) and CASP under MiCA (Markets in Crypto‑Assets Regulation) have become essential. MiCA, adopted in May 2023, fully applies since December 2024 across the […]

How Xpaid Bridges the Gap Between High-Risk Businesses and European Banks

Access to European banking remains elusive for many high-risk industries — such as crypto, iGaming, and cross-border eCommerce. Traditional banks, constrained by AML obligations and regulatory scrutiny, often sideline these sectors. This enduring trust gap impedes growth and limits financial access. Why Banks Avoid High-Risk Clients Banks in the EU and UK are burdened by […]

How to Open IBAN for High-Risk Businesses: A Step-by-Step Guide by Xpaid

Opening a dedicated IBAN in Europe is often a major challenge for high-risk businesses. Traditional banks tend to refuse these clients, citing regulatory exposure, compliance costs, and reputational risks. As a result, many legitimate companies — from crypto projects to gaming, fintech, or nutraceuticals — find themselves unable to access basic banking services LegalBison. According […]