Boost revenue by integrating instant crypto on/off ramp & wallet services

Earn on every transaction with no license required.

No regulatory risk

Secure infrastructure

Launch in just a few weeks

How do banks miss out on profits?

Banks can generate up to $10,000 additional profit monthly on every $1M in transaction volume by offering crypto on/off ramp services.

How Much Can Your Fintech Earn with Crypto Ramp Service?

Integrate crypto. Earn passively. Scale instantly.

Monthly income:

Based on a 1.5% fee per transaction and a total monthly volume of €4,200,000 €4 200 000.

Benefits we offer to banks

New revenue stream

Attract more customers

Expand your customer base by offering innovative cryptocurrency services.

Set exchange fees

Define individual fees for cryptocurrency transactions to maximize profitability.

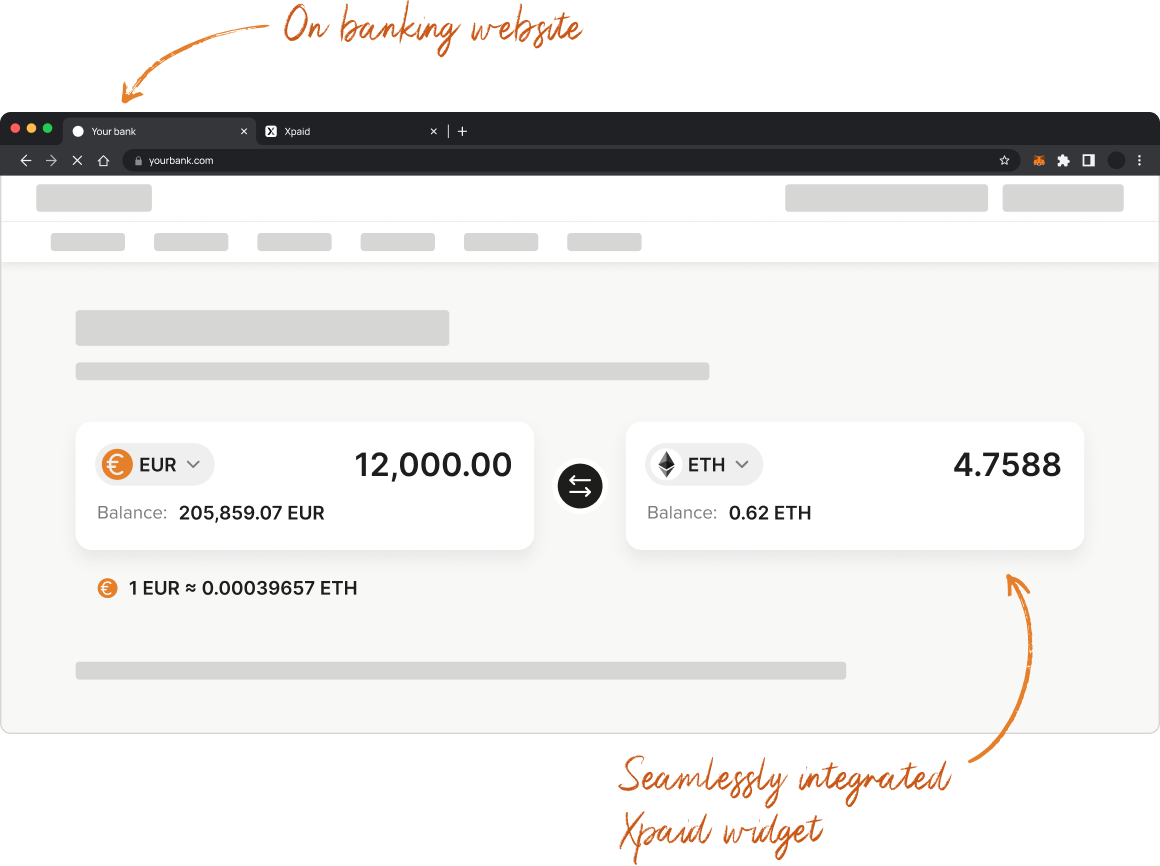

What is Xpaid Ramp for Banking?

Xpaid is a licensed crypto-fiat infrastructure partner for fintechs and banks. We help banks embed crypto buy & sell into their flow without separate infrastructure.

EUR ➜ BNB

Pending

+1.45 BNB

GBP ➜ ETH

Completed

+1.42 ETH

USD ➜ BTC

Completed

+0.04 BTC

Why choose Xpaid Ramp for Banking?

Xpaid Ramp for Banking allows banks to generate revenue by integrating instant cryptocurrency exchanges and wallets directly into their ecosystem.

Fastest time to market

Our solution is designed for rapid deployment and integration, reducing deployment time up to 3 weeks.

No need for a crypto license

XPAID takes on all regulatory obligations. Your bank does not need to obtain a cryptocurrency license.

Configurable and scalable

Customize the design of XPAID RAMP to fit your brand and add features as needed.

Key features

Crypto wallet

Customers can deposit, store, and withdraw cryptocurrency directly in the bank's system.

Instantaneous On/off Ramp

Customers can buy and sell cryptocurrency instantly using their bank accounts. Transactions are executed instantly thanks to XPAID’s internal liquidity.

Over-the-counter transactions

Clients can trade large volumes of cryptocurrency at a fixed price, avoiding slippage and market fluctuations.

Everything You Want to Know About Xpaid OTC Desk

What currencies are available for on/off ramp?

USDC, ETH, BTC ⇄ EUR

Do we need a separate crypto license to integrate Xpaid RAMP?

No. Xpaid handles all legal and operational infrastructure. You act as a front-end provider and don’t engage in regulated activities.

How do we monetize as a partner with Xpaid Ramp?

- Fixed margin per transaction

- Add your own fee on top of OTC spread

- Revenue-sharing model

- White-label under your brand

How long does it take to launch on/off ramp?

- MVP integration: 2–3 weeks

- Full SDK + branding: 3–5 weeks

- Full support across technical, legal, and marketing stages

Can we integrate the ramp under our own brand (white-label)?

Yes. Full white-label integration:

- Branded UI/UX

- Custom domain, logo, and emails

- No Xpaid branding is shown to your clients

Can we use our own crypto wallets with the ramp?

Yes, upon agreement. Options include:

- Your wallet addresses for crypto in/out

- Your custodial wallets

- Cold wallet integration via API

How to srart?

Integrate WEB SDK

Establish a formal agreement to solidify the partnership.

Launch & Grow

Go live in just 3 weeks!

Seamless integration with minimal development effort.

Blog

Follow our latest news and product updates

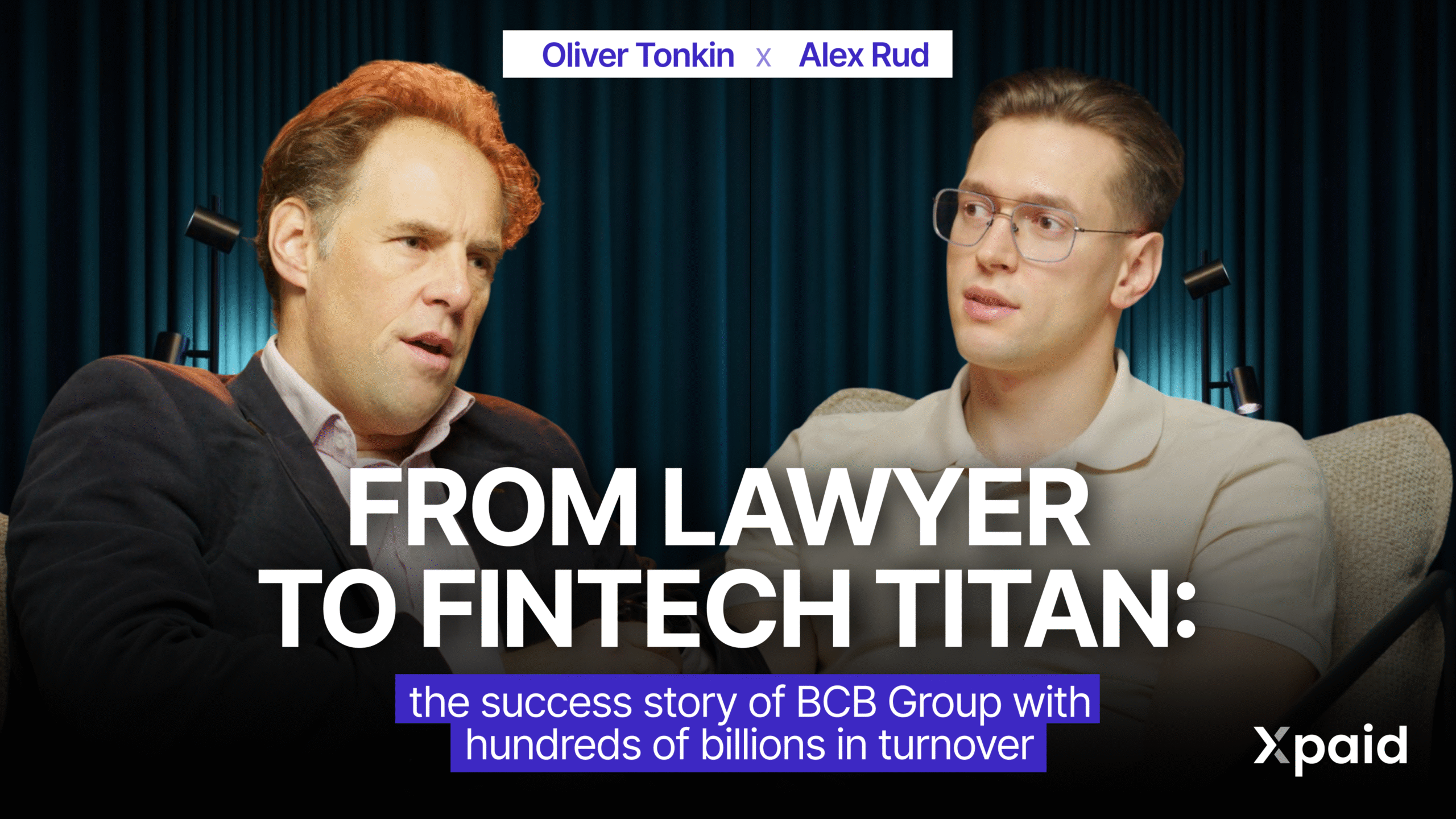

BCB Group is a leading provider of regulated payment and trading services for the digital asset economy. Its experience of going through different market cycles

In today’s digital finance scene, the needs of businesses are growing, as the traditional system is moving a bit slowly towards crypto and the frictions

In the coming year, the attention of cryptosphere participants is expected to shift away from the acknowledged headliners of the market. These used to be

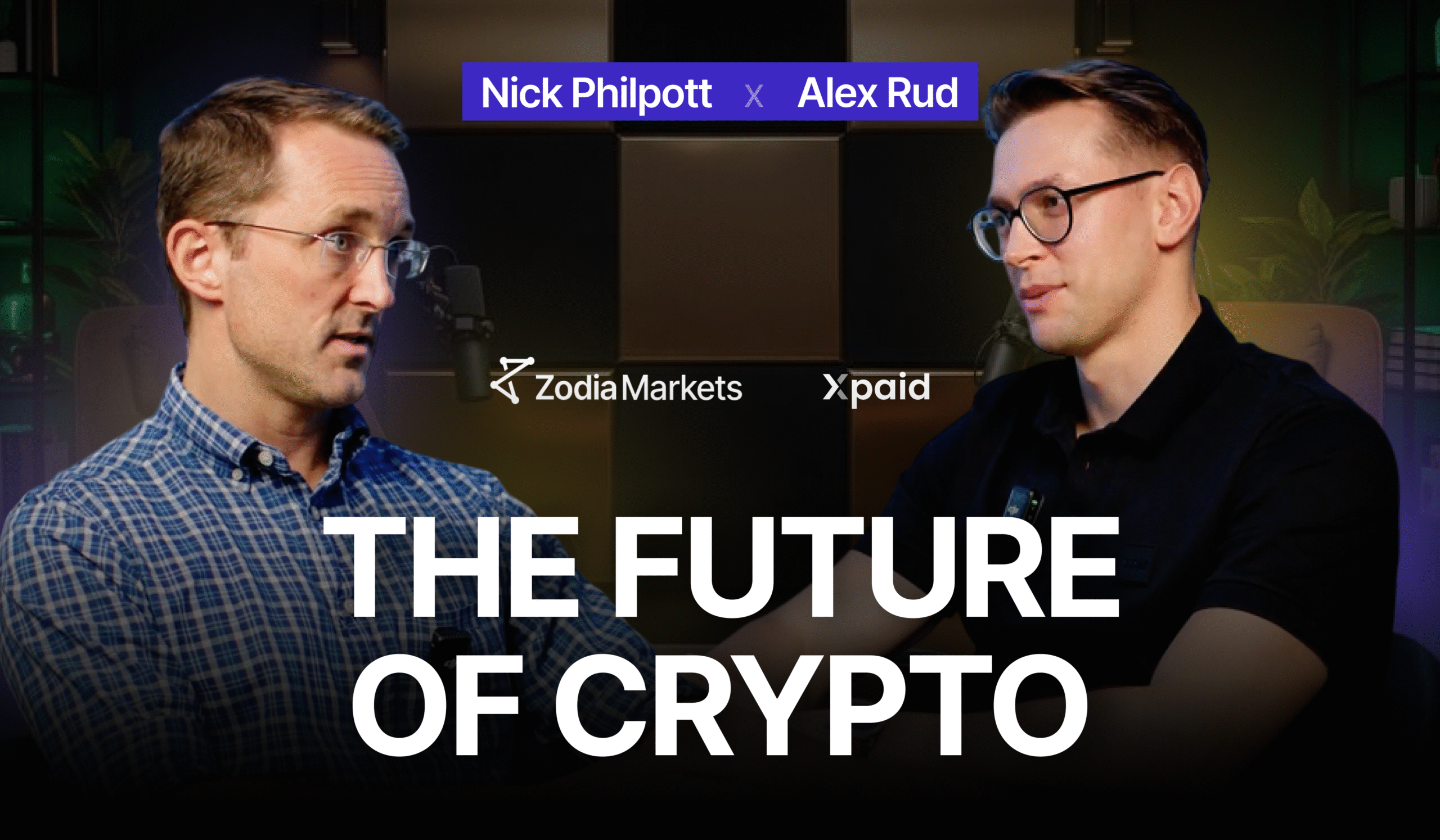

When we talk about the future of payments, the conversation often centers around buzzwords — blockchain, CBDCs, tokenization. But few people can break down what’s

When most people think about building a bank, they imagine decades of tradition, cautious growth, and heavy bureaucracy. Today, OpenPayd is not only redefining the

As cryptocurrencies are widely adopted by all the participants of the financial system, the demand for safe, simple, and transparent tools for their use grows

Today’s financial environment is a dynamic sphere that is rapidly adapting to the needs of users. One of them is adherence to the security standards

In today’s crypto and financial services environment, compliance is not just a requirement — it’s the foundation of legitimacy. For companies operating in and around

Access to European banking remains elusive for many high-risk industries — such as crypto, iGaming, and cross-border eCommerce. Traditional banks, constrained by AML obligations and

Opening a dedicated IBAN in Europe is often a major challenge for high-risk businesses. Traditional banks tend to refuse these clients, citing regulatory exposure, compliance

Ready to transform your wallet services?

Request a demo and see it live in action.