Stablecoins have become one of the fastest-growing segments in digital finance, with a global market cap surpassing $150 billion in 2024 For businesses and consumers, they offer the speed and transparency of blockchain payments while maintaining the stability of fiat currencies. Traditional banks can no longer ignore this trend. Some of the world’s largest players are already experimenting: Citi launched tokenized deposits and settlement pilots with stablecoins in 2023. Yet, despite momentum, the gap between traditional banking and stablecoins in Europe remains wide.

The Gap Between Banks and Stablecoins

Legacy banking systems prioritize compliance, security, and risk management — values often at odds with the openness and speed of blockchain networks. While stablecoins provide near-instant settlement and global reach, banks are wary of regulatory scrutiny and exposure to money-laundering risks. The European regulatory landscape, shaped by MiCA and AMLD frameworks, requires strict oversight of digital assets. This has left many businesses, especially SMEs and high-growth companies, struggling to access reliable crypto-to-fiat services through their banking partners.

How Xpaid Bridges the Divide

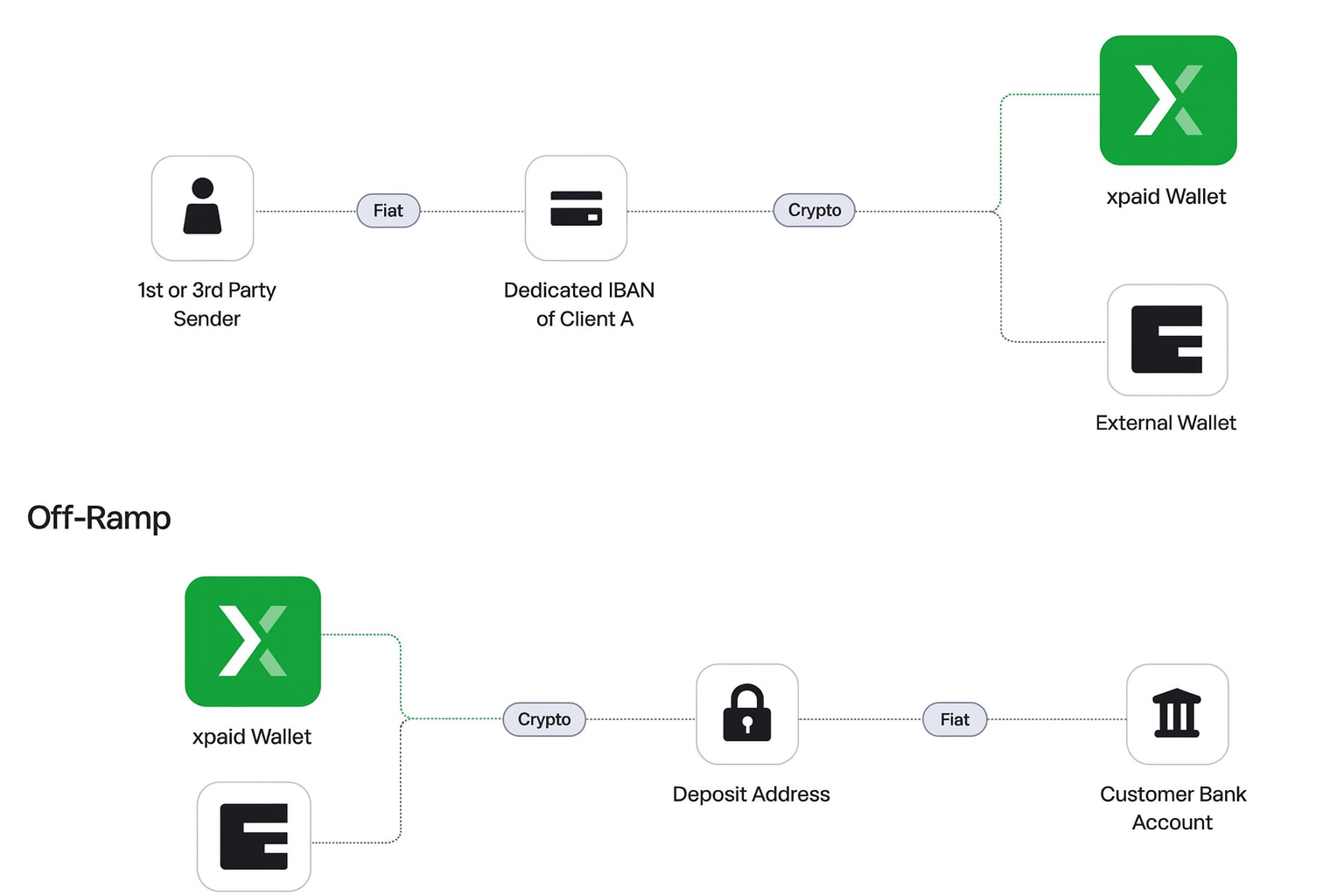

Xpaid positions itself as the compliant bridge between stablecoins and the European banking system. As an Electronic Money Institution (EMI), Xpaid integrates on/off ramp infrastructure that enables businesses to settle payments in stablecoins and receive payouts directly into euro-denominated accounts. In practice, Xpaid operates as a crypto ramp for banks, embedding regulated infrastructure that connects stablecoin settlements with euro accounts. This isn’t just about technical rails — it’s about making crypto payments work inside the regulatory and operational framework banks demand.

For high-risk industries and cross-border businesses, Xpaid provides a secure alternative where traditional banks hesitate. The platform supports seamless onboarding, transparent reporting, and ensures that stablecoin transactions meet the same compliance standards as fiat transfers. By embedding its infrastructure into PSPs and fintech partners, Xpaid turns crypto settlements into a business-ready service.

Business Advantages of a Stablecoin Ramp

For enterprises and PSPs integrating stablecoin payments, three benefits stand out:

- Speed: Transactions settle within minutes, reducing the liquidity gaps of traditional banking.

- Compliance: By aligning with European regulatory frameworks, businesses avoid the risks of unregulated crypto ramps.

- Transparency: Stablecoin settlements provide auditable, blockchain-based records, minimizing disputes and increasing trust with partners.

The result is a financial stack that combines the innovation of digital assets with the reliability of traditional finance. Businesses can expand globally, pay suppliers faster, and maintain regulatory peace of mind.

Xpaid as a Trusted Partner

Stablecoins are reshaping the future of global payments, but adoption in Europe requires trust, compliance, and seamless banking integration. Xpaid delivers all three. By bridging the gap between legacy banks and digital assets, it enables entrepreneurs, investors, and enterprises to unlock new opportunities in a regulated and secure way. For businesses looking to future-proof their financial operations.