Seamless Crypto Payments & Exchange for Businesses

Get a ready-made crypto payment solution with Xpaid: from opening corporate accounts to implementing crypto processing.

Payments without blocks

Accept crypto and fiat without the risk of account freezes. Operate legally and seamlessly within the European regulatory framework.

Automated KYC & transaction screening. Let us handle compliance, while you focus on your business.

Швидкі розрахунки напряму — без банківських затримок і комісій третіх сторін. Ми поєднуємо гнучкість крипти з надійністю фіату.

Some Data

Businesses that adopt crypto payments see up to +327% ROI and save up to 80% on transaction costs.

Cut costs and unlock higher margins with next-gen payment infrastructure, built for high-risk regions and complex business models.

According to BitPay

In 2025, businesses face real challenges:

Broken communication between businesses and banks

Restrictions on high-risk industries: iGaming, Crypto, AI

SWIFT and SEPA transfers blocked by bank AML algorithms

Low payment conversion rates and declining customer trust due to banking issues

Xpaid Solves This

Crypto payment tools built for businesses. IBAN onboarding, crypto conversion, and full payment integration.

Why many still avoid crypto payments:

We help resolve these concerns through infrastructure, compliance, and operational support.

Xpaid: a turnkey all-in-one solution

Xpaid streamlines financial operations to power your business with speed and confidence

Stablecoin Settlement

High-risk–friendly accounts with instant crypto ↔ fiat settlement

Crypto Payment Gateway

Cryptocurrency processing, with automatic conversion to fiat or storage in stablecoins.

Our compliance team ensures:

No need for your own crypto license — everything runs under Xpaid’s licenses.

Two EU crypto licenses: Lithuania & Poland

Transitioning to MiCA (CASP)

Onboarding support

Beneficiary verification

Transaction audit

Tax structuring consulting

Xpaid streamlines financial operations to power your business with speed and confidence

Companies in high-risk industries

Financial funds, SaaS, developers

Internationally operating legal entities

EMIs searching for OTC or ramp solutions

Businesses and Services that Accept Crypto

Everything You Want to Know About Xpaid OTC Desk

Can your solutions be used for crypto-financing international operations?

Yes. We specialize in crypto payments and legal capital flow for international businesses.

How can I get the pricing?

Just click "Request Rates" — and we'll get back with a tailored offer.

Is my transaction data kept confidential?

Yes. All transactions comply with European GDPR and are processed with the highest level of protection.

Що таке “Digital Asset as a Service” (DAaaS)?

Це інфраструктура під ключ, яка дозволяє бізнесам надавати криптовалютні послуги (обмін, сетлмент, зберігання, OTC-угоди) легально, без потреби у власній ліцензії чи технічному бекенді. DAaaS охоплює гаманці, ліквідність, AML/KYC, обмін крипто/фіат і фінзвітність.

Чи можливе White Label рішення від Xpaid?

Так. Ви можете запустити власний OTC або DAaaS-сервіс під своїм брендом на базі інфраструктури Xpaid. Ми забезпечуємо всю операційну частину, комплаєнс, ліцензії — ви працюєте з клієнтами та заробляєте.

З якими ліцензіями працює Xpaid?

Xpaid працює в рамках кількох регуляторних юрисдикцій:

Poland, (VASP,) Active

Lithuania, (VASP), Active

Canada, (MSB), Filed

UAE (Dubai), (3D), In progress

Kazakhstan, (VASP), In progress

Our team: Experts in the Global Payment Ecosystem

Blog

Follow our latest news and product updates

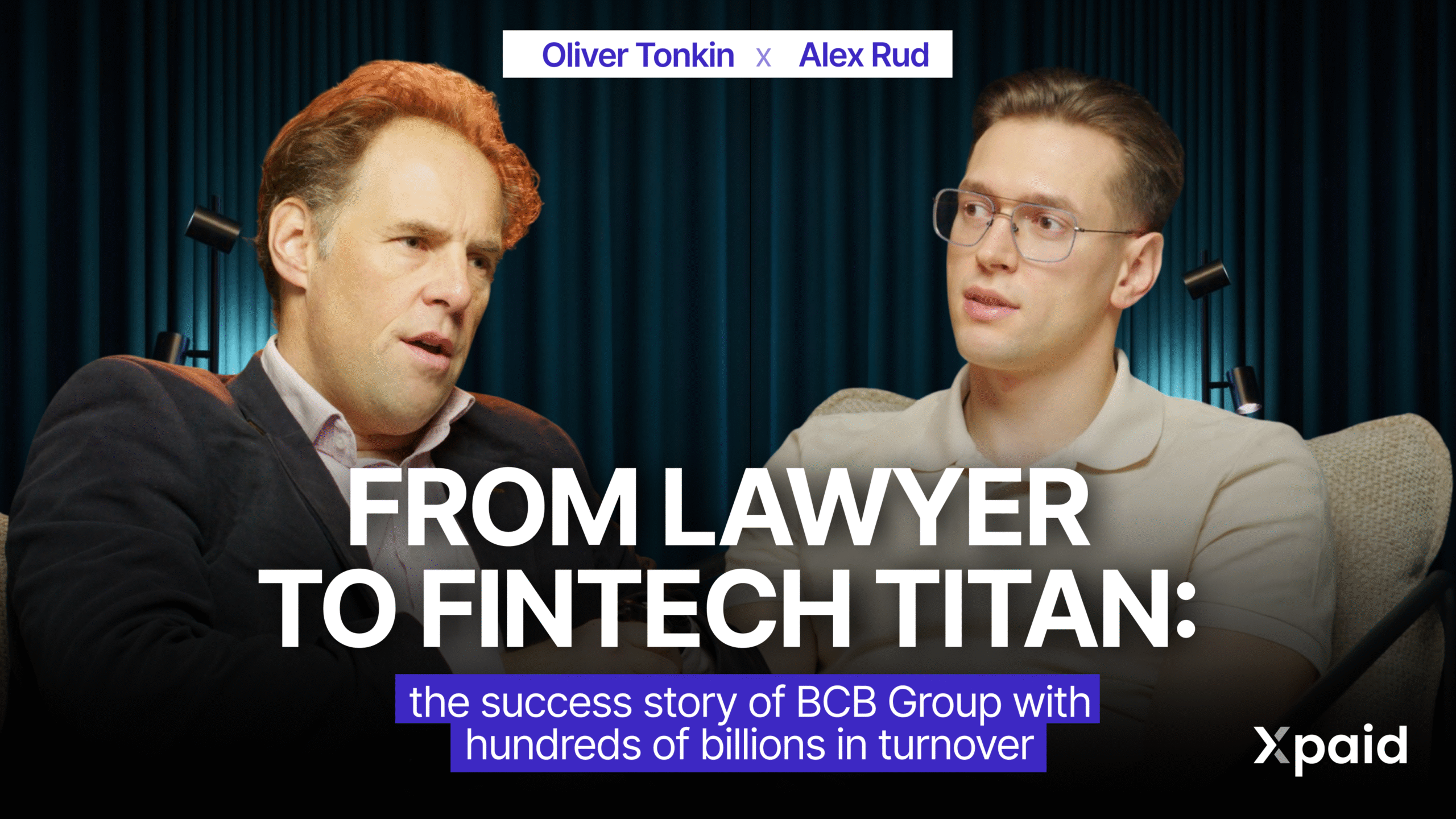

BCB Group is a leading provider of regulated payment and trading services for the digital asset economy. Its experience of going through different market cycles

In today’s digital finance scene, the needs of businesses are growing, as the traditional system is moving a bit slowly towards crypto and the frictions

In the coming year, the attention of cryptosphere participants is expected to shift away from the acknowledged headliners of the market. These used to be

When we talk about the future of payments, the conversation often centers around buzzwords — blockchain, CBDCs, tokenization. But few people can break down what’s

When most people think about building a bank, they imagine decades of tradition, cautious growth, and heavy bureaucracy. Today, OpenPayd is not only redefining the

As cryptocurrencies are widely adopted by all the participants of the financial system, the demand for safe, simple, and transparent tools for their use grows

Today’s financial environment is a dynamic sphere that is rapidly adapting to the needs of users. One of them is adherence to the security standards

In today’s crypto and financial services environment, compliance is not just a requirement — it’s the foundation of legitimacy. For companies operating in and around

Access to European banking remains elusive for many high-risk industries — such as crypto, iGaming, and cross-border eCommerce. Traditional banks, constrained by AML obligations and

Opening a dedicated IBAN in Europe is often a major challenge for high-risk businesses. Traditional banks tend to refuse these clients, citing regulatory exposure, compliance

Ready to break free from complex banking workflows?

Xpaid will tailor the solution to your business