30+ Specialists in the Team

Borderless Finance

Xpaid brings together banking and digital finance in a single platform.

Clients

already growing with Xpaid

Transactions

processed through the platform in 2025

Experts

in teams across Warsaw and Vilnius

International Partnerships

with real estate agencies, funds, and investment club

Jurisdictions

Poland, Lithuania, and Ukraine with active licenses and local offices

Some Data

From a Startup Dream to a Global FinTech Partner

At Xpaid, we believe finance should be simple, transparent, and without borders.

What began as a small fintech startup has grown into a trusted financial service and a Digital Assets-as-a-Service (DAaaS)…

How Xpaid Became a FinTech Partner for the World

2022 — The Beginning

Xpaid was founded with a mission: to remove barriers…

2023 — Building Trust

We applied for a VASP license…

2024 — Expanding Horizons

Our team grew to 30+ specialists…

2025 — A Breakthrough Year

Xpaid surpassed €500 million in transactions…

2026 — The Future of Global Finance

We are preparing for full MiCA compliance…

Our Mission

Shaping the Future of Finance

To make global finance accessible…

We break down barriers between banking services and digital assets, creating a unified ecosystem for seamless international payments.

What We Stand

Legality and Standards

Xpaid operates strictly within EU regulations…

Infrastructure Without Borders

From IBAN accounts to crypto payments…

Compliance Without Stress

We provide turnkey AML/KYC solutions…

Join us

Join the Xpaid team — we combine banking and crypto solutions, creating a borderless fintech infrastructure. Join us and work on innovative products for Ukrainians in Europe.

Sales Manager (B2C)

Lawyer / Jurist

Partnership Manager

LinkedIn Marketing Specialist

Blog

Follow our latest news and product updates

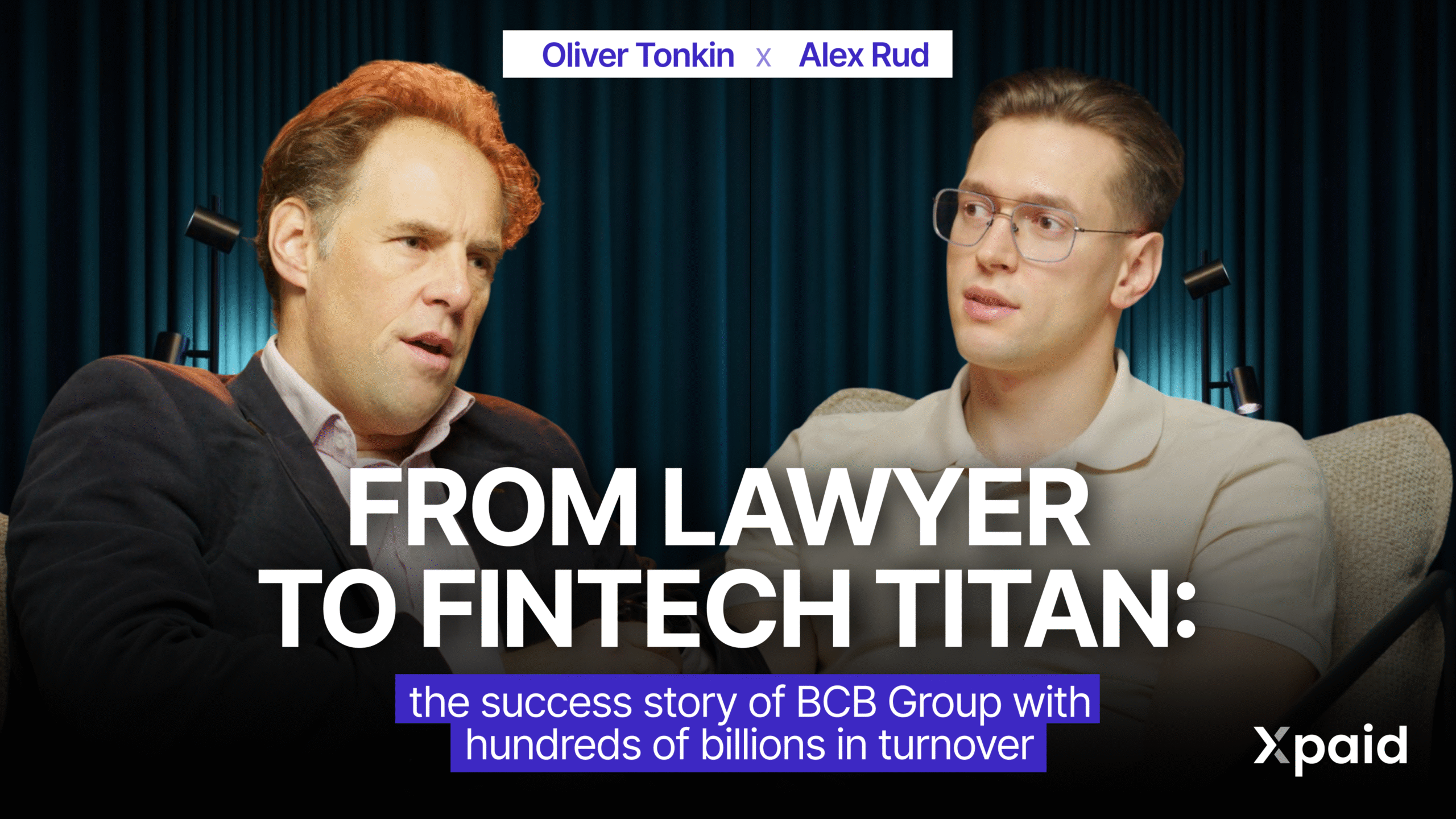

BCB Group is a leading provider of regulated payment and trading services for the digital asset economy. Its experience of going through different market cycles

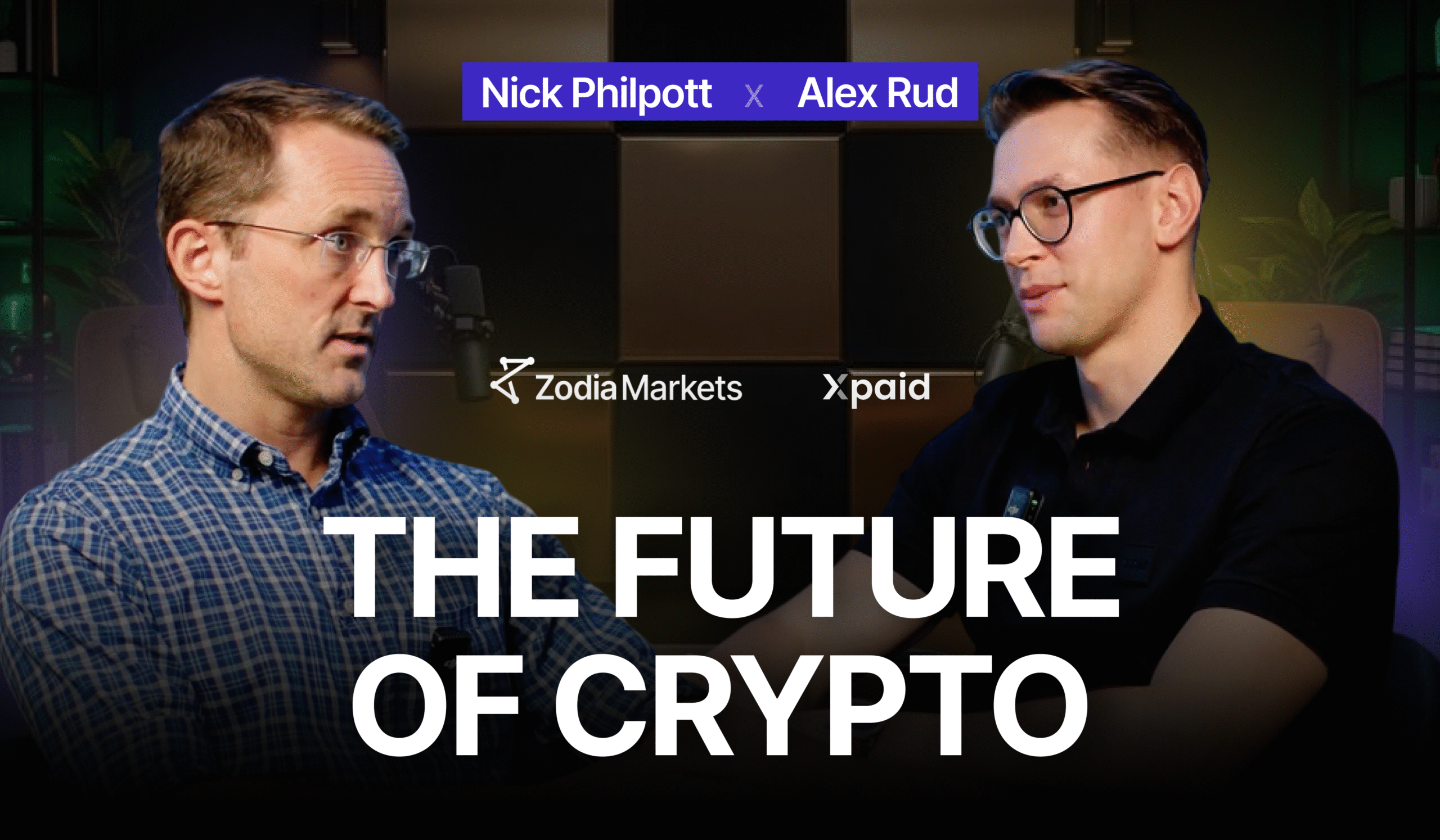

In today’s digital finance scene, the needs of businesses are growing, as the traditional system is moving a bit slowly towards crypto and the frictions

In the coming year, the attention of cryptosphere participants is expected to shift away from the acknowledged headliners of the market. These used to be

When we talk about the future of payments, the conversation often centers around buzzwords — blockchain, CBDCs, tokenization. But few people can break down what’s

When most people think about building a bank, they imagine decades of tradition, cautious growth, and heavy bureaucracy. Today, OpenPayd is not only redefining the

As cryptocurrencies are widely adopted by all the participants of the financial system, the demand for safe, simple, and transparent tools for their use grows

Today’s financial environment is a dynamic sphere that is rapidly adapting to the needs of users. One of them is adherence to the security standards

In today’s crypto and financial services environment, compliance is not just a requirement — it’s the foundation of legitimacy. For companies operating in and around

Access to European banking remains elusive for many high-risk industries — such as crypto, iGaming, and cross-border eCommerce. Traditional banks, constrained by AML obligations and

Opening a dedicated IBAN in Europe is often a major challenge for high-risk businesses. Traditional banks tend to refuse these clients, citing regulatory exposure, compliance